In 2009, Joe, an ambitious designer presented a 14-slide business pitch deck to investors.

Little did he know that this presentation would not only raise $600,000…

But it would also be the foundation of a company with over $100 billion in market value: Airbnb.

Since then, many pioneer businesses have followed them. Giants like Uber, Youtube, and Tesla.

The question is…

What do they know about creating a business pitch deck that most don’t?

How do they raise millions of dollars when most repel investors?

Most importantly, is there a secret formula that you can replicate?

In this post, you’ll learn exactly:

- The 8 core elements of every successful pitch deck (and fatal mistakes to avoid – this will save you from an inevitable “NO!” from investors)

- The “3-Second-Rule” top-tier presentation designers use to keep the audience at the edge of their seats

- 3 Make-or-Break questions your pitch deck needs to answer

AND we’ll look behind the curtains at nine examples of a business pitch that has been used by billion-dollar companies, to uncover their secret recipe for getting funded.

Let’s dive in!

Custom Presentation Design Services – Get your next pitch to stand out, look professional, and inspire your audience to take action. We can help you with your Google Slides or PowerPoint design and your company story development.

What is a Pitch Deck

A pitch deck is a 10-20 slide presentation that provides an overview, a business plan, and a vision of a company.

Many times “pitch deck” is used synonymously with a business pitch deck, investor pitch, investment deck, venture capital pitch, angel pitch deck, sales pitch, and many other ways.

It’s most often used for securing investment opportunities, and it can come in many forms.

Demo Day

This is a short presentation whose primary goal is to sell an idea quickly.

It uses a lot of imagery and usually avoids confidential topics like financials.

Text is minimal, and it relies on the speaker to deliver the message.

Investor Pitch Deck

There are two types of pitch decks, each of which is suitable for a different stage of the company.

Seed

Used for getting your company off the ground, a seed deck will talk about the problem, solution, and the business model your company brings to the table.

It’s 12 slides long or less and should take about 20 minutes to present.

Series (A/B/C) Funding

At this stage, the business has been operating for a year or two.

This presentation must contain the core values of the company and also show healthy financial numbers and marketplace traction to secure additional funding.

Leave Behind

This is a separate presentation (we like to call this the One-Page Pitch) that you send to investors after your pitch meeting (seed or series). Many times this is handed to them after the pitch.

It’s 1 page long (can go up to 5 pages) and it should summarize what you’ve presented.

What Makes a Great Pitch Deck

We analyzed 12 presentations of market-leading companies to identify the secret sauce of their success.

Companies like…

- Tesla

- MOZ

- Uber

- Buzzfeed

- Quora

- Tinder

- Buffer

- Airbnb

- Youtube

Here are the top things that make a pitch deck work (and if your presentation keeps failing, these might be the reasons why).

Use Stories Over Metrics

Everybody loves a good story, including investors.

When your company is in the early stages with few to no financial numbers to show, relatable stories help to sell your idea.

Tell your investors…

- How your product affects (or changes) people’s lives

- How does it compare to your competitors

- How it disrupts the market

- Who are the people behind the company

- What makes them the right team to turn this idea into a success

Keep Things Simple

Avoid overloading investors with information.

Straightforward infographics and illustrations will be your best ally.

A wall of text – not so much.

To make sure your slides are investor-friendly, apply the “3-Second-Rule” to all of your slides.

The 3-Second-Rule

This is a simple, yet extremely effective practice we came up with at The Profitable Pitch.

The concept is simple.

Each slide should contain no more information than you can process in 3 seconds or less.

This achieves two things.

- It makes sure that your audience understands what they see without having to scratch their head.

- It doesn’t take attention away from the presenter for too long.

Use Examples and Use Cases

How do you explain a brand new concept to a person?

By using examples!

Pack your presentation with examples and use cases to help investors visualize the product in use.

(Especially if you’re an innovator!)

Invest in Good Design

Have you heard the proverb, “It’s not what you say, it’s how you say it”?

When it comes to presenting your pitch deck, “how you say it” includes “how it looks”.

This is why presentations nowadays rely more and more on a captivating design combined with good communication.

Twenty years ago, companies could get away with a couple of bullet points. This won’t work anymore.

Know Your Numbers

As much as investors may love your story, at the end of the day, they’re looking for opportunities to profit.

That means they’ll likely have a lot of questions when it comes to financials.

Your pitch deck will be a great guide for this, but only if you make sure you have the answers when it comes to numbers.

We’ll talk about what you need to have exactly on your financial slides later on in this article.

Stay up to date

It takes time to find an investor who’s willing to fork out a large sum for your vision.

As business goes on during this time, make sure to keep your deck updated with the latest information, including…

- Growth metrics

- Financials

- Team (if there were any changes)

- Milestones achieved

This will keep your pitch as relevant as possible each time you present to new investors.

Now, let’s look at what you shouldn’t do.

Be Considerate with Length

What do you think is the most common problem with presentations?

If you guessed “they’re boring,” you guessed right.

Presentations are often long-winded, and that is because presenters mistakenly feel that more information equals more value.

This is not the case.

According to recent studies, people’s attention rapidly declines after just 10 minutes.

Now, your pitch decks’ length can vary based on their type.

A good guideline for presentation length is Guy Kawasaki’s 10/20/30 rule.

“A […] presentation should have ten slides, last no more than twenty minutes, and contain no font smaller than thirty points.”

This will apply to most of the investor or business pitch decks that you present.

However, when you’re sending “leave behind” materials these rules don’t apply, because…

- You can zoom in on PDFs as long as the image quality is high resolution, meaning you don’t need large fonts.

- The receiver has more time to read through the pages, so you don’t need to limit yourself to 10 slides.

Be Ready for Questions

This one ties in with the “know your numbers” rule.

Your pitch deck may be top of the line, but if you can’t answer important questions about your company afterward – you’re toast.

How to Build a Pitch Deck

In the previous section, you learned what it takes to make a winning pitch deck (and what mistakes you should avoid).

In this one, I’ll show you how to build a deck, step-by-step.

Introduction

According to statistics by Forbes, you have seven seconds to make a good first impression.

This is why – particularly for business pitch decks – you shouldn’t neglect the power of your title slide.

The cover should set the tone for the pitch and include the following:

- Company logo and name

- An Image about the product or service, ideally in use (stay away from stock photos!)

- Title (headline)

- Description (subheadline)

- The presenter’s contact information is placed at the bottom

The cover must be simple and concise.

Use large, clearly readable fonts, and high-resolution images (or illustrations).

Problem

This slide should discuss the problem in the marketplace that your company wants to solve.

You should introduce real-life examples, use cases, and stories.

By using a story, your audience will be more likely to empathize with your efforts.

In other words, you can make your audience feel the problem.

Remember, at this stage, you’re selling the idea – steer away from making people switch into “analytical mode.”

If your solution is not new, highlight the opportunity that relies on solving the problem your way.

Your problem slide should address three things:

- What’s the status quo in your marketplace that you’re challenging

- Why does the problem exist

- How relevant is the problem currently (this will also come in handy as a prelude to your “Why Now” slide)

If your problem is complex, make sure to simplify it.

At this point, you should also agitate the problem.

This is part of the “PAS” formula, often used by marketers.

PAS

PAS stands for Problem-Agitate-Solution.

It’s an effective framework for bringing focus to a problem.

Poking the problem to make the audience truly “feel” it.

All the way to closing the deal.

Solution

Now that your audience understands that there is a legitimate issue to be solved, you can move on to present the solution.

The more you can show and the more tangible the solution is, the better.

- If you have a physical product, bring it with you

- If you have a digital solution, give a quick demo

If neither of these is available to you, create high-quality illustrations or even a video.

Even if your solution is not fully developed, it’s better to show more than just plans.

Keep in mind to use your story, as your audience is investing in you in the first place.

Make your solution:

- So irresistible that your customers can’t ignore it

- Exciting and fresh, even if the problem is not new

- Feel your customers delighted after using it

Competition

Every business has competitors, even the most revolutionary and innovative ones.

You are no exception.

In fact, there’s probably someone out there who’s working on a similar idea to yours.

The way you differentiate yourself is through your Unique Selling Proposition – or USP for short.

On your competition slide, you need to tell your investors:

- Who your primary competitors are

- What they do wrong (if they do)

- What you do differently (USP)

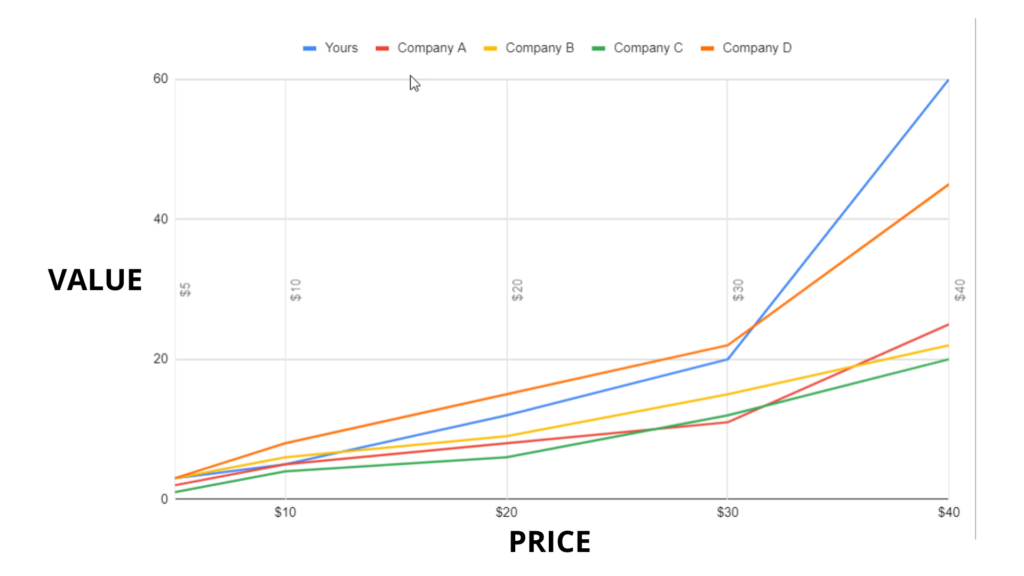

When you offer an existing solution, you should put your competitors and yourself on a “Price – Value” matrix.

This will clarify your product or service’s spot in the marketplace.

It looks like this:

Traction

Have you ever watched a Shark Tank episode?

Have you noticed that investors almost exclusively fund projects that show traction already?

The same goes for online funding drives like Kickstarter or Indiegogo campaigns.

It’s not an accident, and it’s no wonder why.

Growth (even in the very early stages) helps investors gauge a business idea’s potential.

If you can’t show any numbers, provide scenarios for…

- Best case

- Realistic case

- Worst case

If you can provide them, these metrics will matter the most:

- Revenue (one-time purchases, and recurring)

- Average Sales Cycle

- Average Order Value

- Customer Lifetime Value (if your company is not in the seed stage)

- Users/Leads

- Feedback (score)

Important – stay away from vanity metrics. Investors see through these.

Your audience needs to see progress, and positive projections for the future.

The more momentum you can show, the better.

Business Model

This is the strategy of your business (in other words, how your business makes money).

Explain how your business will function, by answering these questions:

- What revenue sources will you have?

- What’s your pricing structure?

- What’s your projected revenue?

About that last one – keep it simple.

You don’t need to draw scenarios; a single figure will be sufficient.

(The rest you will uncover when you get to financials.)

Use a Business Model Canvas before creating this slide.

It will give you a big picture of your business and will help to answer additional questions that may arise at this stage.

Customer Acquisition

“Who are your customers and how will you reach them?” is the question you need to answer.

Let’s start with the first part.

Who is your target audience?

Here are a few things to look at.

(This list is for your benefit. No need to include all of them in your investor pitch deck.)

- Demographics

- Age

- Gender

- Income level

- Education

- Family life cycle

- Religion

- Psychographics

- Personality

- Values

- Attitudes

- Interests

- Lifestyle

- Behavior (if you have existing customers and data to analyze)

- Purchasing behavior

- Benefits they’re looking for

- Customer journey stages

- Timing

- Satisfaction

- Brand loyalty

- Engagement level

- Stage of awareness

- Unaware of the problem

- Problem aware

- Solution aware

- Product aware

- Most aware

- Market sophistication

The more you know about your customers, the better you can pinpoint where and how you can reach them.

This brings us to what your Customer Acquisition slide must have:

- Your target audience’s demographics (narrowed down to 2-3 data points)

- Launch strategy (if you haven’t done that already)

- Long-term acquisition channels

- Cost to acquire a customer

If you’re using a lot of organic and paid channels, try to narrow it down to the ones you prioritize.

Team

Remember that we said that investors are investing in you first?

That is why this slide’s purpose is to build confidence in your team.

Show your audience:

- Who the key members of your team are (include pictures and roles)

- What’s their education and expertise

- What did they accomplish

Financials

Your investors need to know what’s in it for them by funding your visions at the end of the day.

The financial slide should include your:

- Current revenue, profit, and expenses (balance sheet, cash flow)

- Expected revenue for the upcoming years (projections)

- Milestones (when will you breakeven)

You can also use best, realistic, and worst-case scenarios.

Ask

At this point your investors want to know how much are you raising and what for.

Use specific amounts in your pitch deck, and tell your investors how you are going to use the funds.

You can also use an “up to” amount.

Also, tell them what percentage of the company you’re “selling” in exchange for the funding.

Exit Strategy

This slide is not required if you’re not thinking about an exit right now.

Plus, you need to be careful with this slide.

You don’t want to come across as an entrepreneur who’s just in it for the money.

Nonetheless, from the investor’s perspective, the exit strategy is important information.

You can paint a picture of your exit by listing companies that could potentially show interest in acquiring your business.

These may be competitors or even conglomerates who could utilize your technology or customer base.

You should also use references (similar companies who exited), and project a company valuation for the time of the exit.

Why Now

Opportunities come and go, so it’s crucial to know – why is now the best time for your investors to make a decision?

Does your solution fill a gap in the marketplace in a way that’s never been done before?

Do you have access to revolutionary technology?

Do you know insider information that gives you an edge?

Whatever your reasons are, your investor needs to feel that:

- You have a good understanding of the market

- She needs to act NOW

Leave Behind

This is a short summary of your pitch deck.

Send it to investors after the meeting is adjourned.

It should include the following slides:

- Problem and Solution

- Team

- Traction (or financials, milestones, or growth plan)

- Ask

In short, you need to answer:

- What is the problem that you’re solving

- Who you are (team)

- Where are you at and where are you heading

What Investors Look for Exactly

After going through the twelve elements of a pitch deck, you might be wondering:

“Alright, but what EXACTLY do investors want to hear?

What are the most important elements that can’t be left out of a pitch deck?”

Here they are.

Every investor looks for 3 pieces of information to make their decision.

- What you do

- How you make money

- Why does it matter now

Let me explain.

1. What You Do

This can be answered in two ways.

- Use your title slide, which explains who you are and what you do.

- Using the problem and solution slides.

Your audience will want to hear a clear, concise explanation of the problem in a sentence or two.

They also use this information to size up the problem.

2. How You Make Money

This is answered through your Business Model slide.

Again, keep it simple and easy to understand.

3. Why It Matters Now

This will be your last, “why now” slide. It is the most difficult to articulate.

Here are two questions that will help you come up with an answer:

- What’s the result of your company being in the market?

- How does your company make an impact on a larger scale?

Pitch Deck Breakdowns

By now you should know what makes an investor pitch deck successful and how to assemble one.

In this section, we’ll deep dive into nine pitch decks from companies like Tesla, Uber, and Moz, to see real-life examples of a business pitch and the methods that win investors.

This will help you cement the key elements of a successful pitch deck in your brain.

This way, when you start putting your own deck together, you’ll know exactly what to do.

Tesla

What Can You Learn from Tesla’s Pitch Deck

- Strong team slide that gives investors confidence.

- Clear traction numbers through the development of the engineering team, number of stores opened, cars on the road, and miles driven.

- Proof elements are provided using strong strategic partners.

- Product (Model S) prototype displayed with expected sales and planned features.

- Model S reservations show that there’s already a huge existing demand for the product.

- The business model slide shows that the product could be used in multiple ways in the future, giving even more (financial) opportunities for investors who join now.

- Milestones slide explaining exactly how the product’s development will progress.

- Clear figure on the ask slide with additional justification elements that prove why the investment is a good decision.

MOZ

What Can You Learn from MOZ’s Pitch Deck

- The title slide gives a simple, but great story about the past, present, and future of the company.

- The story slide goes into even more detail about the company’s rich history and talks about how the owners were in $500k debt once (similar to team slides – proving that there’s a proper leadership behind the business).

- The traction slide shows the company’s explosive growth with exact figures.

- MOZ’s inbound strategy tells the investors how they’ve built the company using free traffic, which serves as a great explanation for how they have an amazing 83% margin.

- They explain why SEO still has a high untapped potential using proof, and what problems the market faces before going on to explain why this is a huge opportunity.

- Customer acquisition slides pinpoint exactly who MOZ’s target customers are.

- They use a simple explanation of financials without confusing spreadsheet data.

- Ask slide clearly states how much they need and what for.

- Business risks – they go into detail about the potential issues they could face. This is a great marketing tactic. If you’re not sure how your audience might react to a potential problem, bring it up yourself so you can frame their thoughts surrounding the subject.

- Multiple slides explain additional opportunities including exit.

Uber

What Can You Learn from Uber’s Pitch Deck

- Problem slides use relatable issues to explain what’s wrong with the taxi industry and go deeper into explaining the core problem.

- The solution slide summarizes what Uber provides using short bullets (This is good, but it could be greatly improved, especially now in 2021 when pitch decks look vastly different). The “1-Click Car Service” is a great, revolutionary mechanism for ordering taxis. They also explain how it works exactly and use benefits instead of features.

- Key Differentiators, UberCab.com, and Technology slides showcase the features that were new at the time and exciting to the market.

- Operating Principles explain the core values.

- A simple demonstration of the software using a practical “pickup @work in 5” example.

- Plenty of use cases. See why I said: “show, don’t tell”? By giving relatable examples, investors can much better imagine how the product would be used by customers. Uber heavily relied on this, especially because the concept was unprecedented. They also used a lot of comparisons between the problem and the solution.

- Potential Outcomes paints the best, realistic and worst-case scenarios. This is a great way to set expectations.

- The Progress to Date slide shows some traction.

There’s a lot of room to improve this presentation, but let’s not forget Uber received its first round of funding in October 2010.

What Can You Learn from Reddit’s Pitch Deck (Media Kit)

- The traction slide shows massive growth of an important metric for advertisers (monthly page views).

- They use a lot of statistics to back up why it makes sense to advertise on the platform.

- Multiple slides talk about how the product works, how it makes money, and why the platform is so valuable right now.

Reddit is a bit of an outlier with their pitch deck.

They use a lot of humor and memes, and their deck gives a good idea about who their audience is.

Quora

What Can You Learn from Quora’s Pitch Deck

- The title slide gives a great one-sentence explanation about the product, using examples (Yahoo, Facebook) that people are familiar with.

- Team slide builds confidence as all members have strong past work experiences.

- The problem in the marketplace is explained by using examples.

- Why Now slide, cleverly explains the opportunity from multiple angles.

- The solution is defined in one sentence with exciting benefits included.

- The product demo is shown through multiple slides (profile, topic streams, voting system).

- Impressive traction numbers are displayed using easy-to-understand infographics.

- A product’s place in the marketplace is defined using a market positioning matrix.

- Simple timeline for milestones.

- The Ask slide has one clear number.

WeWork

What Can You Learn from WeWork’s Pitch Deck

- The company overview includes what the business has achieved so far.

- What we do slide explains in one sentence what the company does, how it does it, and why it matters now.

- They back up the problem with proof elements (how the workforce is changing in the US).

What Can You Learn from Facebook’s Pitch Deck (Media Kit)

- The presentation starts with a strong quote from a credible source which arouses curiosity and excitement before the pitch deck even starts.

- The company’s purpose is explained in just two sentences

- They showcase the product to explain how the platform works and how it looks.

- They talk extensively about their audience and explain why it’s a great opportunity to advertise to these people. They also tell how many people use the website – a key metric for potential advertisers – as well as the user growth rate.

- The last slides show exactly what Facebook is selling and the options they offer. Targeting based on demographics and interests, various ad sizes, and rates.

Tinder

What Can You Learn from Tinder’s Pitch Deck

- The curiosity-driven tagline on the title slide “flirting game…” makes people wonder what the product is.

- They use a relatable story to explain the problem. (This is extremely helpful! I imagine investors who saw slides 3 and 4 were nodding their heads in agreement as the situation is familiar to most men.)

- Tinder introduces the solution by showing the product in use through pictures about the platform.

- The business model is explained in just three bullets using examples.

Airbnb

What Can You Learn from Airbnb’s Pitch Deck

- The service is explained in a single sentence on the title slide.

- The problem slide touches on multiple valid pain points that people can relate to.

- They use benefit-rich explanations when presenting the solution.

- The market validation slide clearly shows the need for this type of service using examples.

- Product displayed with a simple use case.

- “How do you make money” – Answered on the business model slide along with projections.

- Market positioning is displayed using a matrix, with advantages on the next slide.

- Quotes from the press and user testimonials add extra confidence.

- They present the investment opportunity by putting together the asking price and the projected revenue along with the timeframe.

Final Thoughts

With examples of a business pitch now in your back pocket you can create a profitable pitch for yourself, your next project, or the cause you want to start to impact the world with. So, go forth my friends, and do amazing things.

We have some free Google Slides Templates available for download and free PowerPoint Templates if you need any for your next pitch or presentation.